Mā te tāke tika, e mau roa te iwi: With a just tax system, the people are sustained

In this project, Professor Lisa Marriott and Dr Brian Tunui (Ngāti Awa, Ngāti Pūkeko, Te Arawa, Ngāti Mākino, Ngāti Hamoa), from Te Herenga Waka— Victoria University of Wellington, will explore how tax models that affirm Te Tiriti o Waitangi can be used to support a more just and equitable society for all New Zealanders

Published on 7 Whiringa-ā-rangi November 2024

Before 1840, Māori had the right and capacity to make binding decisions about the wellbeing of their tangata (people) and whenua (land). This right and capacity was affirmed in Article Two of Te Tiriti with Article One granting the Crown kāwanatanga (governorship). Taxation and tax-like practices are essential components of both kāwanatanga and rangatiratanga, allowing governments to raise the necessary revenue to provide services for the public. The current tax system does not honour Articles Two or Three of Te Tiriti, as it infringes tino rangatiratanga and historical promises of equity.

Taxation in Aotearoa, then and since, has resourced the kāwanatanga space, while contributing to dispossession in the rangatiratanga space and gradually erasing Māori self-determination. The current tax system does not honour Article Two or Three of Te Tiriti, as it infringes tino rangatiratanga and historical promises of equity.

To date, no attempt has been made to devise a Te Tiriti-affirming tax system based on systematic research, and Māori voices have rarely been heard in Aotearoa’s tax policy discussions. Professor Marriott, Dr Tunui and their team aim to rectify this by identifying and articulating alternative tax system models that affirm Te Tiriti. Working with the Matike Mai Aotearoa framework for inclusive constitutional transformation, they will inform these models by investigating cases of suspected historical wrongs implemented under the guise of legitimate taxation and historic and current relationships between Māori and tax.

This study builds upon international experiences with alternative taxation structures in the USA, Canada, Wales, and Scotland. These international case studies will help the team explore possibilities that could inform Te Tiriti-affirming tax models. A tax system that affirms Te Tiriti will help to advance the relationships our ancestors envisaged in 1840.

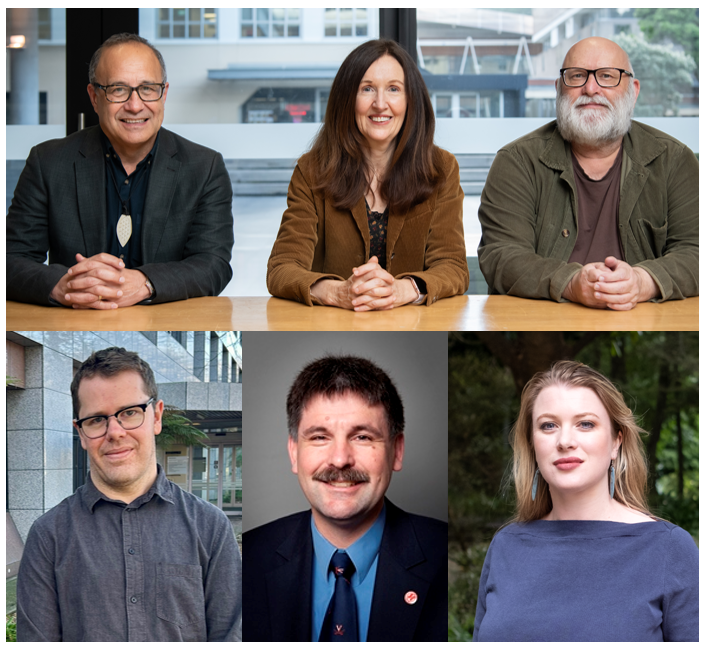

Dr Brian Tunui, Professor Lisa Marriott, Associate Professor Jonathan Barrett, Dr Matthew Scobie, Professor Adrian Sawyer and Rachael Evans (photos supplied)